Why You Should Be Using Multi-Factor Authentication to Protect Your Accounts

In today’s digital landscape, your password alone is no longer enough to protect your personal or business data. Multi-factor authentication (MFA)—also known as two-factor authentication (2FA)—adds a critical second layer of protection to your login process. It’s one of the most effective and accessible ways to protect your accounts from unauthorized access.

What Is Multi-Factor Authentication (MFA)?

MFA works by requiring users to provide two or more forms of identity verification before gaining access to a system. These factors fall into three categories:

- Something you know – your password or PIN

- Something you have – a smartphone, security key, or app-based authenticator

- Something you are – biometric verification like a fingerprint or facial recognition

By combining at least two of these factors, MFA significantly reduces the risk of unauthorized access—even if a password is stolen or guessed.

Why MFA Works: A Simple Analogy

Think about using an ATM. Your PIN by itself isn’t secure—it’s just a 4-digit number. But when paired with your physical bank card (something you have), it becomes a secure two-factor process. The card is useless without the PIN, and the PIN is useless without the card. That’s exactly how MFA enhances security across your digital accounts.

How MFA Protects Your Business and Personal Accounts

With the rise of phishing attacks, data breaches, and password reuse, securing access with multi-factor authentication is essential. Even if an attacker compromises your login credentials, they won’t be able to access your account without your second verification method—like a push notification to your phone or a rotating code from an authenticator app.

Most modern cloud-based platforms, including Microsoft 365, Google Workspace, banking apps, and social media platforms, offer built-in MFA settings. Enabling them is usually as simple as visiting your account’s security settings.

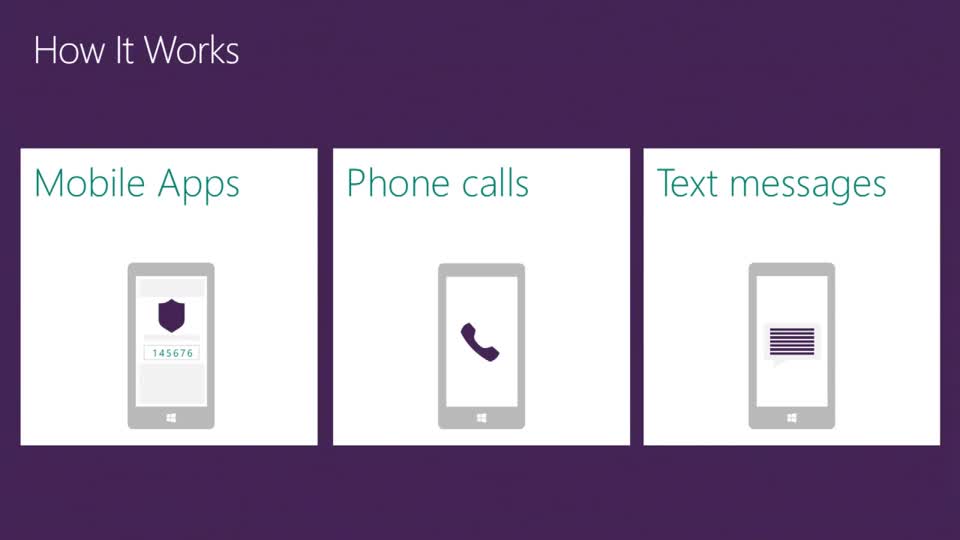

How MFA Works in Practice

Here’s how a typical multi-factor authentication process looks:

- You enter your username and password as usual.

- You are prompted for a second form of verification—such as a one-time code sent to your phone, an app-generated passcode, or a biometric scan.

- Once the second factor is verified, you gain access to your account.

If an attacker attempts to log in with your credentials, they’ll be stopped at the second step unless they also have access to your second factor—which is highly unlikely.

MFA for Businesses: Why It’s Non-Negotiable

For businesses, especially small to midsize companies, implementing MFA is a key part of a solid cybersecurity strategy. It protects sensitive client data, prevents unauthorized access to cloud platforms, and can even help with compliance requirements like HIPAA or GDPR.

MFA is especially important for remote work environments where employees access business data from various locations and devices. Microsoft 365, in particular, supports MFA across email, Teams, OneDrive, and SharePoint—a must-have for any business using the platform.

How Tobin Solutions Can Help

At Tobin Solutions, we help businesses in Milwaukee and beyond secure their digital environments with MFA implementation, Microsoft 365 security configuration, and user training. Whether you’re new to multi-factor authentication or want to ensure your current setup is working effectively, we’re here to help.

Don’t wait for a breach to secure your systems. MFA is simple to implement and provides a massive return on security investment.

Contact Tobin Solutions at info@tobinsolutions.com or call 414-443-9999 to get started with MFA for your business today.

Tobin Solutions is a Milwaukee-based IT service provider specializing in secure cloud setup, cybersecurity strategies, and Microsoft 365 management.